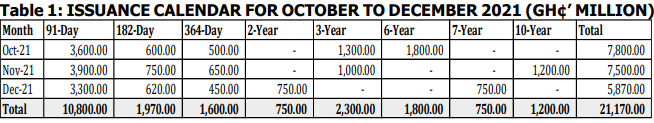

Gov’t to borrow GHȼ21bn in fourth quarter

The government has said it would borrow more than GH₵21.17 billion before the close of 2021.

This was contained in that latest load issuance calendar for the last quarter of 2021, spanning October to December.

“For the period in question, the government plans to issue a gross amount of GH₵21,170.00 million, of which GH₵20,129.30 million is to rollover maturities,” the Finance Ministry stated.

The ministry added that “the remaining GH₵1,040.70 million is fresh issuance to meet the government’s financing requirements” for the various projects outlined in the 2021 Budget for the last quarter.

The majority of the funds to be mobilised would come from the 91-day Treasury bill, a move that has helped reduce foreign debt but rather could have crowded out the private sector from access to financing on the domestic market.

Figures provided by the Finance Ministry explained that the government would borrow GH₵10.8 billion of the 91-day T-bills during the period, lower than the previous quarter.

It will be followed by the 3-year bond, in which a total of ¢2.3 billion will be mobilised. GH₵1.3 billion of that amount will be raised this Thursday, October 14, 2021.

The GH₵1.97 billion is, however, expected to be raised from the 182-day Treasury bill. The month with the biggest amount to be issued will be November 2021, where about GH₵750 million of the short-term securities will be issued.

The GH₵1.8 billion is expected to be raised from the 6-year bond, whilst GH₵1.2 billion is expected to be mobilised from a 10-year bond to be issued in the month of November 2021.

The 2-year and 7-year bonds are expected to raise GH₵750 million each.

Details of the calendar issuance

The government has said, it expects that the October to December 2021 calendar would meet the requirements of market participants.

It has, therefore, assured all stakeholders and the public that it continues to strive for greater predictability and transparency in the domestic bond market.

READ ALSO: Ghana’s Public Debt Balloons To GH¢332.4bn

Ghana’s public debt stock has already increased to GH¢332.4 billion after seeing an additional debt of ¢27.8 billion in April and May 2021.

At the end of the first quarter, the country’s debt was GH¢ 304.6 billion, implying a percentage increment of 9.2%.

According to figures from the recent Summary of Economic and Financial Data by the Bank of Ghana (BoG), the increase has brought the debt to Gross Domestic Product (GDP) ratio to 76.6%.

This is slightly higher than the debt to GDP ratio of 76.1% recorded at the end of 2020, the BoG data shows.

The significant increase in the debt stock is attributed to the $3 billion Eurobond raised in March 2021, in addition to the quantum of borrowing on the domestic market.