How Well Do You Know Ghana’s Old Currencies And Their Corresponding Values Today

Over the years, Ghana’s legal tender (notes and coins) has metamorphosed from various designs into what we have today.

From the pre-colonial era to today, Ghana’s currency has seen many changes. Very few of the younger generation are aware that Ghana used pounds as currency over six decades ago.

A legal tender can be termed as any form of payment recognized by a government, used to pay debts or financial obligations, such as tax payments.

National currencies, such as the Ghana cedi, Nigeria naira, U.S. dollar, and the Zambian kwacha, are legal tender.

In Ghana, the Bank of Ghana (BoG) is authorized to create and issue cedi to the public.

Before introducing the cedi in 1965, the pound and shilling were the currency in use.

The name “cedi” was derived from the word “sedie”, meaning cowrie, a shell money that gained popularity and wider circulation in the latter parts of the 19th Century.

The cedi was equivalent to eight shillings and four pence (8s 4d) when it came into existence.

The “pesewa” represented the gold-dust currency regime’s smallest denomination (quantity). The name was chosen to replace the British colonial penny.

The cedi was first introduced on July 19, 1965, which replaced the Ghana pound, shilling, and pence which were the first currency introduced by the central bank, the Bank of Ghana(BOG), after independence.

In July 2007, the country’s currency, cedi (¢), was re-denominated to the Ghana Cedi (GH¢), such that ten thousand cedis is equivalent to one Ghana cedi. The redenomination did not affect the intrinsic value of the currency.

In monetary economics, redenomination is changing the face value of banknotes and coins in circulation. It may be done because inflation has made the currency unit so small that only large denominations are in circulation.

Many Ghanaians still remember the slogan which was on the lips of government officials at the time – “the value is the same”.

When redenomination occurred, old banknotes and coins were typically taken out of circulation, and a new currency was issued.

The cedi redenomination removed four zeros such that the ¢10,000 note was equivalent to a new GH¢1 note.

The currency redenomination was beneficial to Ghana’s economic growth. It made the government of Ghana initiate policies to boost local production to support the exercise to increase GDP and other associated economic variables.

While significant inflation is the main reason for a country to re-denominate its currency, other reasons include decimalization or joining a currency union.

Does redenomination change value?

Based on experimental research in 2007, redenomination increased the selling price when inflation was high. Otherwise, when inflation was low, redenomination could decrease the selling price. DDifferencess in economic growth conditions did not affect selling price changes after redenominations did not affect selling price changes after redenomination.

Despite the changes over the years, the country does not own a mint and current printing is undertaken by foreign entities.

Ghana has employed firms in Germany and France to print cedi notes in the past.

Most recently, it has been De La Rue, a security printing firm based in the United Kingdom.

Due to the high security involved in printing, most firms are usually tight-lipped about the processes.

However, it is believed that it costs the country huge sums of money hence the constant advocacy by the apex bank to the public to desist from defacing, crumbling or activities that damage the notes.

It is reported that the Bank of Ghana spent GH¢337.5 million in printing currency notes, according to its 2020 Annual Report.

This is compared with GH¢306.2 million the previous year. According to the report, the Central Bank also spent GH¢7.9 million in 2020 on other currency management operations, as against GH¢3.9 million in 2019.

Here are some old and new currencies with their corresponding values(worth) today

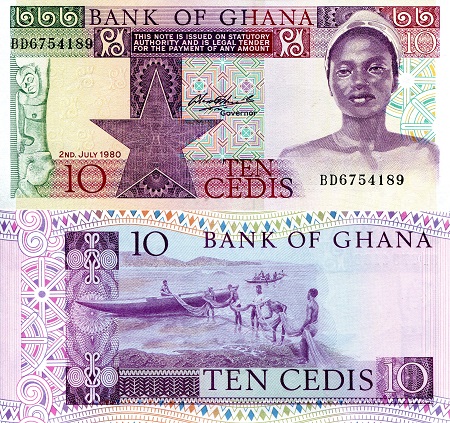

This is the ¢10,000 cedi note before the re-domination in 2007. After the re-domination, it became GH¢1, as known today by many. The intrinsic (commodity) value of the note remains intact whiles the face value has depreciated over the years resulting from economic phenomena.

Before now, ¢10,000 could do much for a household compared to the same for GH¢1 today.

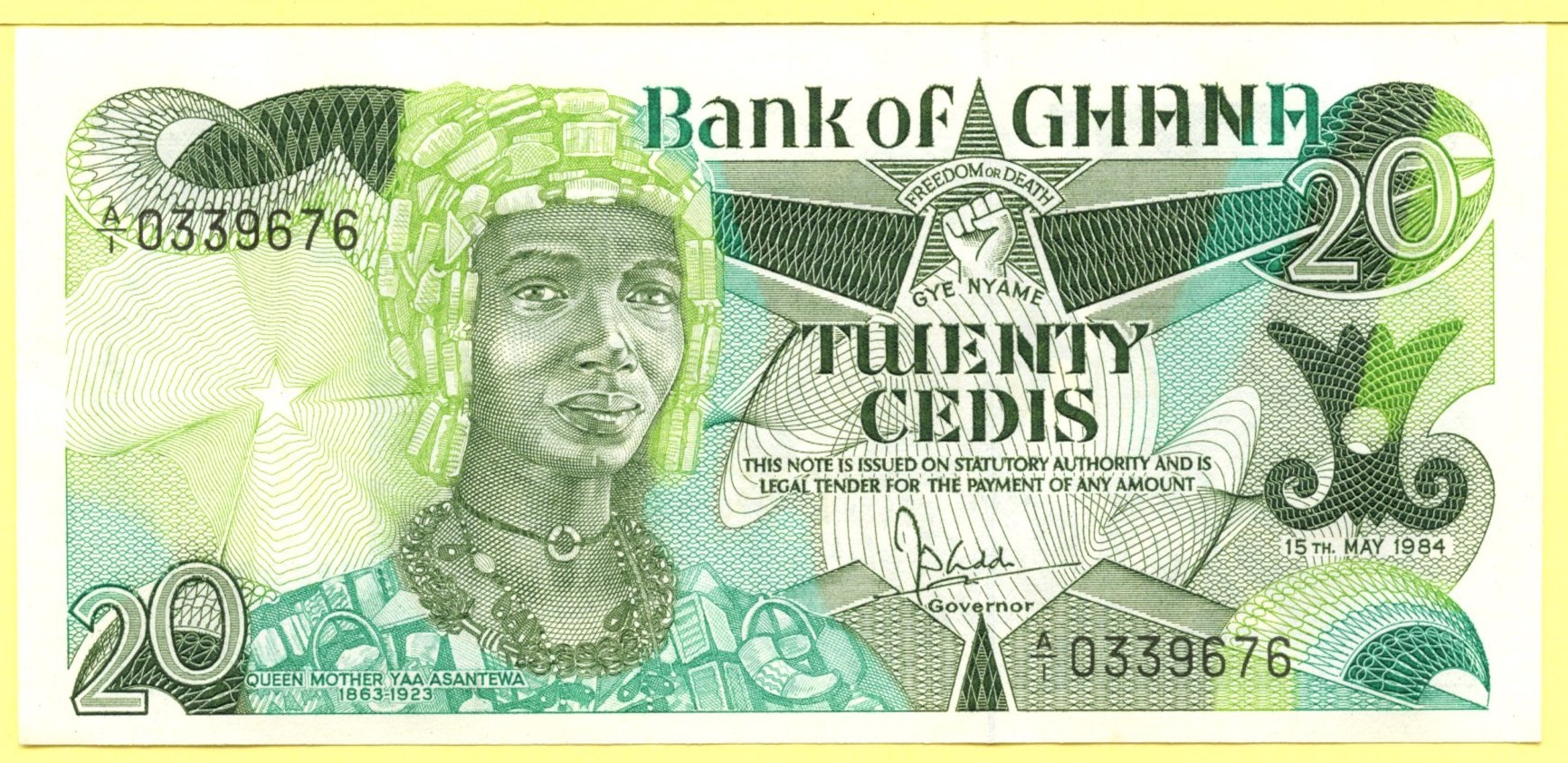

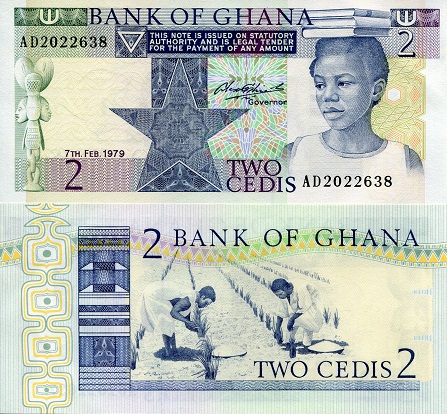

The ¢20,000 note, equivalent to GH¢2 today, has had an enormous change in its face value since its introduction. It is believed that the former’s value had significant standing before the redenomination.

It was considered a higher denomination among the notes hitherto the redenomination.

Its current value holds little or no weight in the current affairs of 2023.

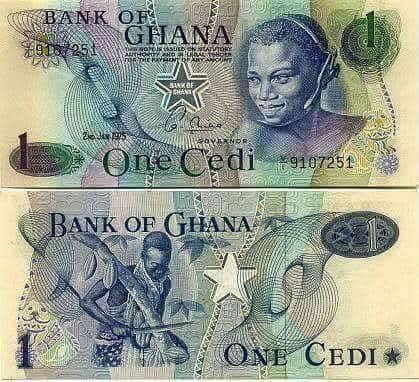

Yes, that is the current state of the old ¢2000.

It is now the 20 pesewas coin, that is, if you are wondering if it is the correct re-dominated note turned coin. It has depreciated massively in both the face value and commodity front because the 20 pesewas cannot even buy a pure water sachet.

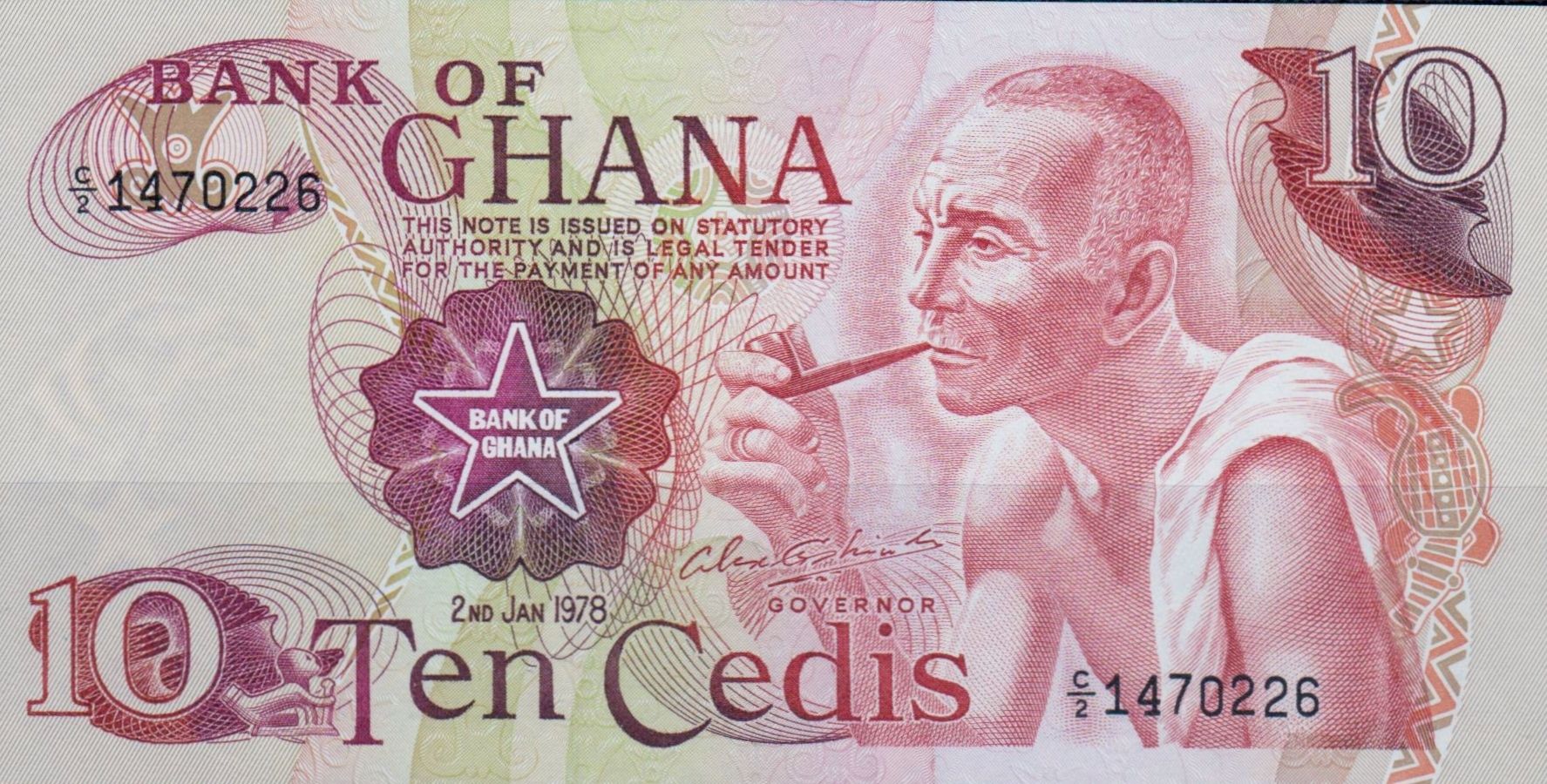

Any person who had the opportunity to experience and use the value of the ¢5000 note and the 50 pesewas would never accept how the two currencies are deemed to have the same value.

The 50 pesewas can buy a sachet of water, but that is all it can do in Ghana in 2023.