Prof Alabi in trouble over GH¢300,000 UPSA cash

Former Vice-Chancellor of the University for Professional Studies (UPSA), Professor Joshua Alabi, is expected to refund with interest almost GH¢300,000 paid to legal firm Lithur Brew and Company.

According to the Auditor General, the management of UPSA signed a retainer agreement dated 16th March 2014 and paid GH¢263,670.00 to the law firm as a retainer fee without evidence of the provision of any legal services to the university.

Hence, Professor Alabi is to refund the monies with interest at the current Bank of Ghana interest rate

The Auditor-General further advised that the management of UPSA sets up a legal directorate that shall facilitate all legal matters for the university through the Attorney General’s department.

This was contained in a report of the Auditor General on public boards, corporations and other statutory institutions for 2019.

What were the findings of the A-G?

According to the Auditor-General, out of a total amount of GH¢2,302,369.67 released to some officers of UPSA to transact official business on behalf of the University, only GH¢353,279.43 was accounted for with the necessary supporting documents leaving a difference of GH¢1,949,090.24 to be accounted for, though the activities for which the funds were released had been conducted long ago.

A breakdown of the report indicated among others details of the payment of GHC 40,772.55 for Prof Alabi and his family to travel to Spain.

However, GHC 19, 142.55 was accounted for leaving GHC 21, 630.

The A-G indicated that there was “No receipt to account for fund”.

There, therefore, recommended that the amount be adjusted to the personal advance accounts in the names of individual imprest holders in line with Regulation 288(1) of the Financial Administration Regulations.

The Auditor-General further noted that Lithur Brew and Company was appointed through sole-sourcing without recourse to the provisions of the Public Procurement (Amendment) Act, 2016 (Act 914).

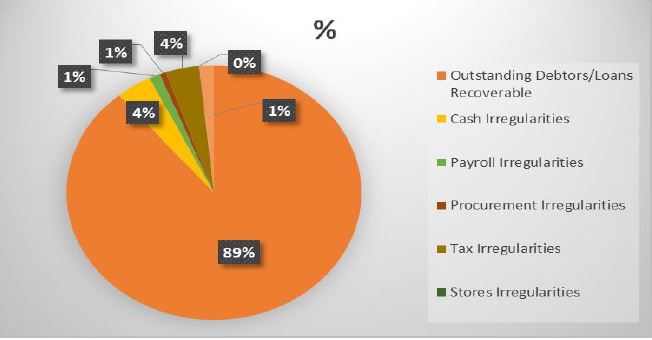

Financial irregularities account for ¢5.46bn uncovered in 2019

In total, GH¢5.46 billion of financial irregularities in state institutions were uncovered in the year 2019 on Public Boards, Corporations and other Statutory Institutions covering the period 2019.

Outstanding Debtors/Loans Recoverable formed a chunk of the monies to the tune of GHC4,859,727,984.

The total irregularities figure of GH¢3.3 billion for 2015

decreased to GH¢718million in 2016.

Total irregularities went up to GH¢12.1 billion in 2017. However, the total irregularities declined by GH¢8.9 billion from the 2017 figure to GH¢3.1 billion in 2018 and went up by 81.8% to GH¢5.5 billion in 2019.

Outstanding Debts/ Loans Recoverable – GH¢4,859,727,984.00

These irregularities represent trade debtors, staff debtors and outstanding loans.

Included in this figure is an amount of GH¢3,643,789,172.39 loans granted by SSNIT to other 16 related institutions who have defaulted in paying back the facility and workers contributions due from Controller and AccountantGeneral’s Department.

Absence of effective debt collection policies, non-existence of credit controls to retrieve the debts and

Management’s indifferent posture towards loan recovery contributed significantly to these anomalous conditions.

Also, improper maintenance of records on debtors, the absence of debtors’ ageing analyses, non-documentation of agreements stipulating the terms and conditions of loans, failure to ensure that loans are repaid and Management’s non-compliance with rules and regulations accounted for these irregularities.

“I recommended that the Management of Public Boards, Corporations and other Statutory Institutions should strictly adhere to rules and regulations with regards to debts management.

“They should also put in place proper policies for the management of loans as well as ensuring that loans are repaid on due dates to avoid or minimise the occurrence of bad debts,” the Acting A-G Johnson Akuamoah Asiedu, said.

Cash Irregularities – GH¢215,025,782.00

Cash irregularities related to the misapplication of funds, non-retirement of imprest, payments not authenticated, payment of Board Allowances to Council Members without Ministerial approval, losses envisaged from projects undertaken by corporate entities and outright cash shortages.

Out of the total figure of GH¢215,025,782 cash irregularities, GH¢80,914,176.00 represented loss envisaged by SSNIT as a result of the affordable housing projects undertaken by SSNIT.

These occurred as a result of poor oversight responsibility, non-existent controls. Other contributory factors were finance officers’ failure to properly file and keep records, Management’s failure to ensure the security and safety of vital documents, non-maintenance of returned cheque registers and management’s inertia in complying with procedures stipulated in the Public Financial Management Act; and poor accounting systems.

“I, therefore, urged the Management of the Public Boards, Corporations and other Statutory Institutions to strengthen supervisory controls over their finance officers, and ensure that they adhere to the provisions of the Public Financial Management Act 2016, (Act 921). I also recommended the authentication of all payment vouchers, prompt payment to bank and full retirement of accountable imprest on due dates.

Payroll Irregularities – GH¢66,248,946.00

These lapses were caused by the failure of Management to exercise due diligence, and the laxity of officers in charge of payroll validation in reviewing payment vouchers to ensure salaries were paid to only those who were entitled as well as payroll related irregularities. They were also caused by Management’s failure to notify banks to stop the payment of unearned salaries. The

Controller and Accountants General’s Department also did not promptly delete names of separated staff when notified to do so. In other instances, Management also did not obtain financial clearance from the Ministry of Finance before employing new staff. Contained in the total irregularity of GH¢66,248,946.00 is an amount of GH¢44,367,132 attributed to GRIDCO in respect of outstanding compensation payments without the requisite documentation and non-payments of 2017 3rd tier pensions contribution from GRIDCO which remained unremitted as 31st December 2017.

“I advised Management of the affected Institutions to promptly notify the bankers of the separated staff to withhold and pay to government chest all unearned salaries. I also recommended that officers in charge of payroll should exercise due care in the discharge of their duties”.

Procurement Irregularities – GH¢37,342,867.00

These irregularities occurred as a result of Managements’ non-compliance with the provisions of the Public Procurement Act 2003, (Act 663). Of the total irregularities $3,000,000.00 (GH¢13,530,000) represented improper procurement of IT services by the University of Cape Coast from KLEOS UK LTD.

“I once again recommended that Management of the various Institutions should undertake procurement transactions strictly in accordance with the provisions of the Public Procurement Act”

Tax Irregularities-GH¢199,651,868.00

The Tax irregularities related to failure to pay statutory tax deductions on due dates, and non-deduction of applicable taxes. They also related to transaction of business with non-VAT registered persons or entities.

“I recommended that the Finance Officers should strictly adhere to the tax laws to ensure that all tax revenues are promptly collected and paid to the applicable revenue agencies”.

Stores Irregularities – GH¢2,748,551

These irregularities include non-documentation of store items, lack of awareness of officers assigned to store duties, inadequate supervision, and non-reconciliation of fuel purchases with fuel station records. Included in the sum of GH¢2,748,551 is an amount of GH¢1,060,805.25 for abandoned equipment procured by Cocoa Research Institute between 2009 and 2012.

“I recommended the strengthening of controls over store management and accounting and also recommended strict adherence to Rules and Regulations that governs the effectual conduct of public financial business”.

Contract Irregularities – GH¢87,625,433

These mainly relates to overpayment of contract sum, absence of signing of contract agreements, failure to comply with tendering procedures, delay in construction, ineffective control over contracts and the absence of transparency in the disbursement of funds, non-recovery of mobilisation and irregular additions to existing contracts.

“I, therefore, urged Management to strengthen controls over contracts and comply with tendering procedures”.