See the list 18 mutual funds, unit trusts not affected by the revocation of 53 Fund Management licences

Contrary to perceptions that the Securities and Exchange Commission’s licence revocation affected Mutual Funds or Unit Trusts, the exchange says it is not so.

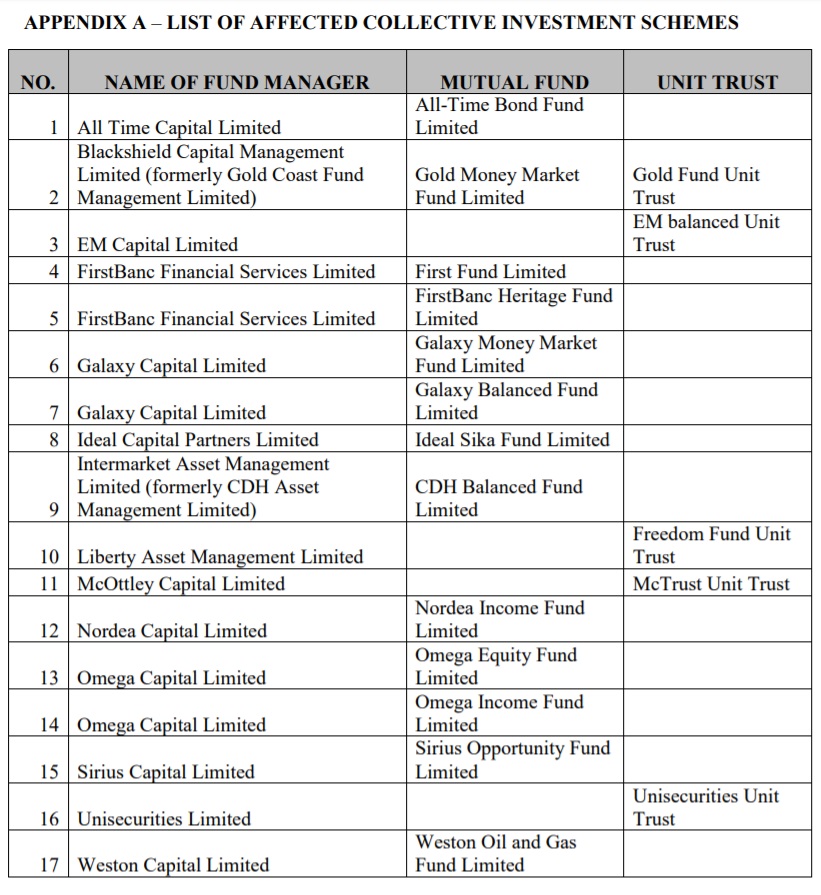

It has released a list 18 Collective Investment Schemes (CIS) in the form of Mutual Funds or Unit Trusts which have not been affected by the revocation of the licences of their respective fund managers.

A press release issued by the SEC said the revocation of the licences of the Fund Managers neither affects the valid licences nor terminates the Mutual Funds and Unit Trusts that they used to manage.

The release added that shareholders and unitholders of these Mutual Funds and Unit Trusts are, therefore, not included in the ongoing submission of claims process at branches of Consolidated Bank Ghana Limited (CBG).

Total number of CIS not affected is 18; made up of 13 mutual funds and 5 unit trusts as listed below;

“In accordance with section 88 (6) of the Securities Industry Act, 2019 (Act 929), Boards of Directors (for Mutual Funds) and Trustees (for Unit Trusts) of affected CIS are to ensure that the schemes continue to run in the best interest of shareholders/unitholders by appointing new fund managers to operate the CIS,” the release said.

“Investors of affected CIS shall be advised by their respective Boards and Trustees when the fund managers are appointed or any other option taken in accordance with Act 929”.

Background

On Friday, November 8, 2019, the Securities and Exchange Commission (SEC) withdrew the licenses of 53 fund management companies pursuant to Section 122 (2) of the Securities Industry Act, 2016 (Act 929).

The SEC said the affected companies failed to return client funds which remained locked up in, contravention of the investment rules.

“Essentially, they have failed to perform their functions efficiently, honestly and fairly and in some cases are in continuing breach of the requirements under relevant securities laws, rules or conditions, despite opportunities provided to them by the SEC within a reasonable period of time to resolve all regulatory breaches,” a statement issued by SEC said.

The SEC on Monday, November 18, 2019, commenced a process to validate the claims of the customers of the 53 fund management companies.

Read the entire release below;

Public Notice on Mutual Funds and Unit Trusts Managed by Fund Management Companies