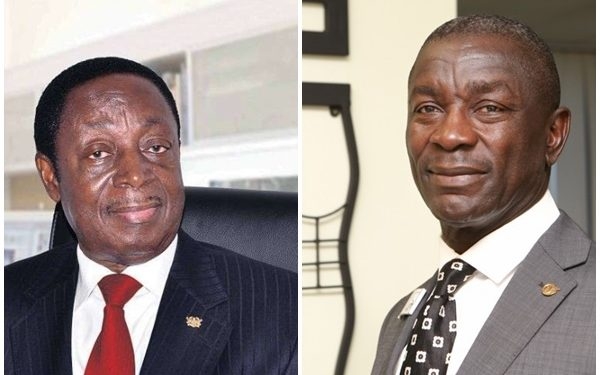

Duffuor, Amoabeng petition Parliament over UT Bank, UniBank collapse

Entrepreneurs Prince Kofi Amoabeng and Dr Kwabena Duffuor have petitioned Parliament to probe the revocation of their banking licenses.

Mr Amoabeng, former CEO of collapsed UT Bank wants the legislature to address the takeover of his bank by the Bank of Ghana (BoG) and delisting from the Accra bourse by the Ghana Stock Exchange (GSE).

On the other hand, Dr Duffuor, a former Finance Minister and founder of the defunct Unibank, is seeking redress for losing his financial firm.

Dr Duffour also lost UniCredit, a savings and loans firm.

The businessmen want their financial firms restored and compensated for the damages caused to them and their investors.

The licenses of the banks were revoked as part of a wider financial sector cleanup.

The apex bank cited insolvency and inability to recapitalise as reasons for taking action and proceeded to prosecute some directors over reported criminal acts.

Minority Spokesperson on Finance, Cassiel Ato Forson, hinted on Friday that Parliament will consider the petition on Monday, March 22, 2021.

The Speaker of Parliament is expected to rule on the matter.

However it is unclear if the petition would be forwarded to the Finance Committee of Parliament or a special committee to address the issue.

What is Mr Duffuor seeking?

He is requesting that Parliament:

-Investigates the conduct of the Bank of Ghana in the takeover, the appointment of an Official Administrator of uniBank Ghana Limited, and the circumstances of the revocation of the banking license of uniBank Ghana Limited;

-Directs the restoration of the banking license of uniBank Ghana Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

-Gives any other directives that Parliament may deem appropriate.

What is Mr Amoabeng seeking?

Mr Amoabeng, is also seeking that the legislature:

-Investigates the conduct of the Bank of Ghana and the Ghana Stock Exchange for the revocation of UT Bank’s license and delisting the bank without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.

-Directs the restoration of the banking license of UT Bank Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

-Gives any other directives that Parliament may deem appropriate.

Background

BoG announced reforms and a financial sector clean-up in 2017 following a decision to revise the minimum capital requirement from GHC120million to GHC400million.

Some nine local banks, 23 savings & loans companies, 347 microfinance institutions and 39 finance houses had their licences revoked.

After the action of the BoG, the Securities and Exchange Commission (SEC) also stepped in to shut 53 fund management companies.

The BoG on August 14, 2017, began revocation of the licences and approved that the good assets of Capital Bank and UT bank be taken over by GCB Bank while it appointed Vish Ashiagbor of PwC as receiver to make the most out of the remaining assets.

A year later, the apex bank revoked the licenses of five other banks – Unibank, Construction Bank, The Royal Bank, Beige Bank, and Sovereign Bank – and announced that their good assets have been merged to form Consolidated Bank Ghana.

The affected banks included Heritage Bank Limited (HBL), Premium Bank and GN Bank.

The central bank’s decision, however, is being contested by some of the shareholders of some banks that lost their license.

Notable among them are the shareholders of Unibank which took on the BoG claiming their license revocation was done arbitrarily without recourse to them.

Finance Minister-designate Ken Ofori-Atta has said the banking sector clean-up exercise cost the Ghanaian taxpayer total of GH¢21 billion, which he has described as a “financial enslavement legacy” from the erstwhile Mahama administration.

The Ministry of Finance is proposing a tax of 5 per cent on gross profit from the banks to defray the debt.

It is subject to review after four years.