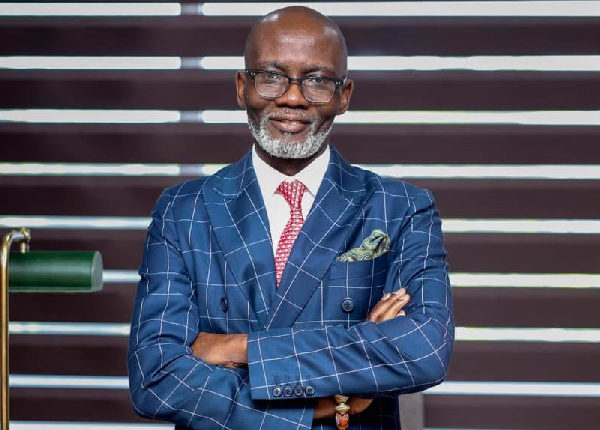

Gabby Otchere-Darko writes: Agyapa royalties and Africa’s old paradox of plenty

In 2018, the Parliament of Ghana, with the active involvement of both sides of the House, debated, improved, and approved the Minerals Income Investment Fund Bill, 2018 (Act 978). The President subsequently assented to the bill and inaugurated the board on Friday, October 4, 2019.

The nine-member board, chaired by MP for Tarkwa, George Mireku Duker, include the CEO of the Fund, Yaw Baah, barrister and former MP for Kumawu, Dr. Maxwell Opoku-Afari, Deputy Governor, Bank of Ghana, Mr. Amiishadai Owusu-Amoah, the Commissioner for Domestic Tax Revenue Division, GRA, Felicia Ashley, Director, Ministry of Finance, and Antoinette Kwofie, Executive Director, Finance, ABSA Bank, Ghana.

This is a very innovative initiative which other resource-rich African countries will happily embrace depending on the success story of pioneering Ghana.

The objects of the Fund, as stated under Section 2 of Act 978 are to: “(a) maximise the value of the income due the Republic from the mineral wealth of the country for the benefit of its citizens; (b) monetize the minerals income accruing to the Republic in a beneficial, responsible, transparent, accountable and sustainable manner; and (c) develop and implement measures to reduce the budgetary exposure of the Republic to. Minerals income fluctuations.”

The powers of the Fund, under Section 4, include, “(a) create and hold equity interests in a Special Purpose Vehicle in any jurisdiction in furtherance of its objects, and the Special Purpose Vehicle shall be free to operate as a regular, commercial company; (b) procure the listing of the Special Purpose Vehicle on any reputable stock exchange that it considers appropriate.”

A statement issued by the Fund Wednesday, August 19, 2020, explains: “The purpose of listing Agyapa Royalties Limited is to allow the Government of Ghana, via MIIF, to raise non-debt capital to invest in the country, without further increasing our national debt burden.”

When swearing the MIIF board in, President Akufo-Addo stressed to the members that they held the Fund in trust for the people of Ghana:

“These monies belong to the people of Ghana and they are counting on you to use it judiciously, prudently, and also with some imagination,” he stated.

The Fund has become a victim of its own innovativeness, caught in the whirlwind of the frustrating finitude of an apprehensive society. It appears not to be properly understood and with three months to general elections, has become just another fodder for opposition propaganda canon.

Fundamentally, Africa, for centuries, has been sitting atop the world’s most significant untapped mineral reserves. But here is the tragedy. At the same time, majority of Africans live in abject poverty, because our governments do not make enough money to provide the basic needs of the people, such as water, electricity, education, housing, and infrastructure.

At the heart of this is the ancient resignation on the part of our leaders that we are too poor to develop rapidly, inclusively and sustainably, without being arrested by debt. It is called the paradox of plenty ––the greatest challenge to the necessary push for Africa Beyond Aid.

But, this is just one part of the story. The other side of the story is what Guinea’s first president, Ahmed Sèkou Touré, described to French leader Charles de Gaulle in 1958 as “riches in slavery.” 1958 was the year the West African nation broke ‘free’ from France. Exactly 50 years on, BSG Resources, a company owned by Israeli-French billionaire, Beny Steinmetz, got a lucrative iron ore mining concession for the Simandou mountain range in Guinea. The country was desperate to get the resources mined. So BSGR got the concession for free; invested a disputed amount of $165m on exploration. Two years later, he sold 51% of BSGR’s stake in Simandou to a major iron ore producer, Vale of Brazil, for $2.5 billion.

Guinea has one of the richest deposits in the world for both iron ore and bauxite, which, if leveraged fairly optimally, the local economy can benefit in excess of $500 billion over the next decade alone. But, whiles the multinational concessionaires are free to go onto the money market and use the licenses and reserves they control to raise capital, the Guinean government had, as it is typical with all others on the continent, resigned itself to mainly sitting tight and waiting for production to begin to earn its fraction.

DRC’s $25 Trillion Minerals

According to a report by the Africa Progress Panel, the Democratic Republic of the Congo, a nation which best epitomises Africa’s paradox of plenty, lost at least $1.36bn in just a two-year period due to knock-down sales of mining assets to offshore companies. Indeed, the story of Democratic Republic of Congo should inspire every African to weep and say: we can do better! The size of Western Europe, DRC is potentially the richest country in the world, with untapped deposits of minerals estimated in excess of $25 trillion. Ravaged by war, locked inside the jaws of scavengers, the Congolese are amongst the poorest people in the world. This must change and can change!

When it comes to the extractive industry, where much of Africa’s riches are buried, exploration and development is a serious capital intensive process. So, we usually give the untapped riches out cheaply on concession, fortify the attractiveness of the deal for the speculator with stabilization clauses, leaving us to rely on small percentages of proceeds in royalties, taxes and charity (CSR) which may only come in if the concessionaire decides to invest beyond exploration to produce and sell the proven reserves and, sometimes, after the investor’s frontloaded costs are recovered. This, sadly, remains the paradox of Africa’s riches.

This was not what Patrice Émery Lumumba, Sèkou Touré, and Kwame Nkrumah had in mind. According to the Bank of Ghana, the country’s share of mining wealth that goes to the communities directly impacted by mining activities is some 0.11%, and the Government of Ghana typically receives in total an amount not exceeding 1.7% share of the global returns from our own gold. For example, a study of $5.2 billion worth of gold exported by foreign-owned mining firms from Ghana over a period, showed that our Treasury received only $68.6 million royalty payments and $18.7 million in corporate income taxes.

It is this centuries-old depressing reality which the Mineral Income Investment Fund is seeking to help challenge. It is not a scheme to perpetuate the ills of old. No! Rather, it is to say, if we can’t beat them then let us, at least, join them out there in leveraging our fair share of the wealth from our own asaase – our land.

Glittering Gold Prices

As we in Ghana argue and wallow in the mud of our self-imposed limitedness and unexamined skepticism, gold prices are glittering, rising by 30% as investors seek refuge in the precious metal amid the COVID-19 pandemic, which is causing untold havoc to economies big and small. Ordinarily, the emergence of the Minerals Income Investment Fund should have been hailed as prophetic. But, that would be asking for too much, surely!

But, beyond all the noise here, the Fund is seen by those who know to be one of the most creative instruments ever to come from Africa in attempts by the continent’s current leadership to correct the structural imbalances when it comes to sharing the benefits from Africa’s enormous wealth. The rest of the continent is waiting eagerly to follow Ghana’s visionary lead with Agyapa Royalties in floating royalties on stock markets to raise money to develop without borrowing.

It is not for nothing that all the medium to major international players operating in the extractive industry in Ghana is listed on stock markets, at least through their parent companies, elsewhere. They need money to develop their business. We need money to develop our country.

For example, in mining, Newmont is listed on the New York Stock Exchange, Asanko Gold is on the Johannesburg Stock Exchange and Azumah Resources is on the Australian Stock Exchange. Cape Coast Resources is listed on the Toronto Stock Exchange and so on and so forth. The same is with petroleum.

In fact, we have had gold companies listed on the Toronto Stock Exchange and Australian Securities Exchange whose only assets were (are) their mining concessions in Ghana. Once they secure a resourceful concession, they do an IPO and float shares of the company on the stock market to raise money. The discovered assets, especially if classified as proven reserves can support greatly the company’s balance sheet.

We saw that with Dow Jones-listed Hess Corp of the US. It got its oil concession, the Deepwater Tano Cape Three Points block, in Ghana around the same time as Kosmos and Tullow, found oil, which raised its share value, but never invested further to produce a single drop of oil all the while only to sell on to Aker Energy in 2018 to raise even more money to develop a bigger hydrocarbon asset it had subsequently acquired in Guyana.

After taking over, the Norwegian company invested to drill more wells and discovered even more oil a few months later; the announcement of which alone led to the share value of Aker ASA rising on the Oslo Børs even before the appraisal was done. And, all these times that share prices of concessionaires in Ghana were going up in value, Ghana got no direct benefit.

It is this imbalance that the Government of Ghana seeks to change with the establishment of the Minerals Income Investment Fund.

President Akufo-Addo, when inaugurating the board, stated, “the operation of this fund could be a critical step in the development and transformation of our economy.”

In fact, there is absolutely no hidden agenda or hidden owners of what the Akufo-Addo government seeks to do with MIIF and its SPV, Agyapa Royalties. MIIF is 100% owned by the Government of Ghana. Agyapa Royalties is 100% owned by MIIF. MIIF was established by an Act of Parliament, which also expressly allowed MIIF to set up an SPV for the purpose of listing on stock markets in Ghana or elsewhere.

You don’t set up an SPV in Jersey if your idea is to hide money only to float that SPV on the highly regulated London Stock Exchange. We must give credit to a thinking government that is determined to express its competence to change the way we do things in Africa for Africa to benefit more and for Africans to prosper inclusively.

The author is Senior Partner, Africa Legal Associates, a commercial law firm in Ghana which specializes in the extractive industry.

this is the dumbest thing I’ve seen this whole month