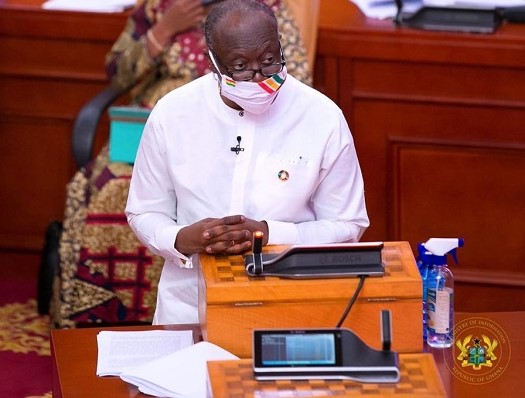

Finance Minister, Ken Ofori-Atta, is expected to lay the 2022 Budget Statement and Economic Policy of Government to Parliament today (Wednesday, November 17).

Ahead of the presentation, the ministry announced that the budget will primarily focus on expanding the economy’s recovery from the COVID-19 pandemic, as well as creating a climate-friendly entrepreneurial state to address unemployment and import substitution.

Digitalization of the economy, skills development and entrepreneurship will also feature prominently in the presentation.

The government expenditure for 2021 was estimated at GH¢ 111.3 billion and likely that the country will spend more in 2022.

Within the first half of the year, the government spent GH¢50.6 billion against the GH¢55.1 billion targeted expenditure.

There was a revenue shortfall of GH¢4.1 billion. At the end of the first half of the year, the government raked in GH¢28.3 billion as against the target of GH¢32.4 billion.

Government is under pressure to meet revenue targets. However, it is unclear if new taxes are going to be introduced.

Ghanaians have expressed hardships and have been crying for the government to review existing taxes on various products.

The Chamber of Petroleum Consumers (COPEC), for example, has reiterated calls for the government to remove taxes and levies on petroleum products to give respite to Ghanaians.

Private transport operators had threatened a demonstration over fuel hikes due to taxes but called off the protests in anticipation of an intervention by the Minister of Finance.

The Coalition of Private Road Transport Operators on Tuesday, November 09, 2021, gave the government an ultimatum to reduce taxes on fuel, threatening to ground all commercial vehicles by 1500 hours Thursday, November 11, 2021.

A few days ago, the Ghana Revenue Authority (GRA) removed benchmark value on some 32 items to boost local industries.

The 32 affected items include palm oil, crude and refined oils, noodles, toilet and facial tissue, chocolate, clinker, mosquito coil, vehicles, ceramic tiles and aluminium products.

Others are cartons, water, plastic, tile cement, textiles, iron steel, fruit juices, tomato paste, cement paper bags, furniture and parts, toilet and laundry soap, detergents, soft drinks, alcoholic beverages, pharmaceuticals, cigarettes, machinery and equipment as well as biscuit.

Whiles the Association of Ghana Industries (AGI) has welcomed the move, the Ghana Union of Traders Association (GUTA) believes it will cause a spike in the prices of goods, especially imported products.

Among other things, Mr Ofori-Atta is expected to address debt sustainability, COVID-19 recovery and infrastructure expansion programme.

For the Institute for Statistical, Social and Economic Research (ISSER) of the University of Ghana, they want the government to introduce policies that would ensure efficiency in the country’s tax administration.