Banking Sector Records GH¢4.3 bn Profit-After -Tax In June

Ghana’s banking sector recorded GH¢ 4.3 billion profit after tax representing a 51.4 percent increase in June 2023 compared to a GH¢2.8 billion profit recorded in 2022.

The banking industry’s total asset also recorded GH¢242.4 billion indicating a 21.2 percent annual growth compared to 22.8 percent growth in June 2022.

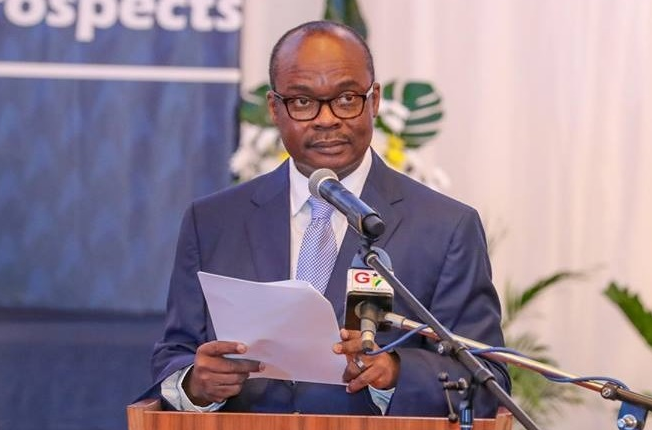

Governor of the Bank of Ghana (BOG), Dr. Ernest Addison who made this known at the 60th anniversary launch of the Chartered Institute of Bankers, Ghana said “the strong asset growth reflected mainly in investments, particularly short-term investments, while medium to long-term investments declined. Notwithstanding the increases in income levels, costs within the banking sector also increased, reflecting spillbacks from the operating environment”.

According to the Governor the increase in costs, however did not outweigh earnings, resulting in the strong profit-before-tax in the first half of the year.

He said the banking sector data for the first half of 2023 also reflected some improved performance despite declines in some key financial soundness indicators coupled with some consensus reached among industry stakeholders and the treatment of losses and the temporary prudential and regulatory reliefs by the Bank of Ghana.

He added that the banking industry also posted losses of GH¢8.0 billion in 2022, compared with a profit of GH¢7.4 billion recorded in 2021 while the main profitability indicators, namely, return-on assets and return-on-equity, turned negative in 2022 because of the industry’s loss position.

He mentioned that the losses reflected the challenging operating environment that prevailed in the year as contained in the 2022 audited financial statements.

While commending the Institute for its immense contribution to the banking industry despite the challenges, he also tasked members to reflect on the theme, “Redefining professionalism in banking through ethics” and rethink the core measures that would help build a more sustainable and trustworthy financial industry.

Dr. Addison further called on management of banks to prioritize ethical leadership, invest in ethics training and education, clear and comprehensive codes of conduct, robust whistle-blower protection among others while asking the Institute to consider incorporating issues such as financial crime, cyber security, role of boards in governance, operational resilience, senior management culture and conduct rules among others in a newly ‘executive leadership programme’ introduced by the institute.