Gas prices have soared over recent days, with geopolitical volatility rattling spot markets and escalating fears of supply shortages this winter.

Having seemingly calmed from last year’s bumper commodity rally when prices topped out at record highs following Russia’s invasion of Ukraine, Europe’s benchmarks are surging again – with the UK recording its highest prices since February.

These worries have been reflected on the spot market, where the Dutch TTF Futures market and UK Natural Gas Futures are trading at €55.28 per megawatt hour and £1.39 per therm respectively heading into next week’s trading, roughly treble conventional trading levels.

It consolidates a more than 30 percent uptick in prices over the past week, while longer-term contracts are also rising for the winter months by hefty margins.

Gas prices spike as instability rattles markets

The upswell shows that gas prices remain driven as much by events as fundamentals, with multiple factors spooking markets again.

Hamas’ attack on Israel has introduced fresh uncertainty into markets, with the country closing its Tamar gas field in the Mediterranean.

There are also fears of sabotage in Europe, after a leak was identified on a 77km-long Baltic Sea gas pipeline between Finland and Estonia – barely a year after the Nord Stream pipeline was ruptured – and with sustained pressure from the Kremlin on European gas flows.

Domestic gas prices have dropped heavily this winter but a recent uptick has left investors spooked (UK Natural Gas Futures – ICE)

Industrial action in Australia is also a persistent challenge, with workers at two major LNG facilities accounting for seven percent of global supplies threatening further disruption amid an ongoing pay dispute with bosses Chevron.

LNG – liquefied natural gas – has been vital for meeting supply demand in Asia and increasingly Europe, with any shortages risking a highly competitive market for gas, which will only cause markets to rally further.

Wrapping together these mounting challenges, the unseasonal warmth in recent weeks across Europe is finally expected to ease with autumn finally dawning on the continent.

No blackouts this winter, experts predict

Nevertheless, experts are not worried over supply shortages this winter – with most forecasts more bullish than last year’s, and Europe’s gas storage topped up at 97.7 percent of capacity.

The latest report from the London Stock Exchange Group is also optimistic, the forecasters expecting the risk of depleted storage to only be ‘minimal’ across all three of its projected scenarios – ‘mild’ ‘central’ and ‘cold.’

Its base case, ‘central’, suggests storage levels at the end of this winter will remain at a comfortable level of 46 percent of capacity over winter – with the prospect for oversupply in the summer, which could cause gas prices to tumble once more.

National Grid’s operational forecast for this winter remains bullish (National Grid)

Meanwhile, National Grid’s latest winter outlook is more bullish than last year’s reports, which had raised the fear of blackouts.

Those past concerns failed to materialise, with only two sessions of the demand flexibility service – where customers are compensated in exchange for saving energy – kicking in at peak times.

This time around, the electricity system operator has raised its expected margin of safety this winter from 3.7GW to 4.4GW – in line with most winters.

All of this points to a manageable winter in terms of supply, despite the fears over geopolitical volatility.

What it fails to ease are concerns over costs – with prices indicators of the burden households and businesses will still face.

Households and businesses still on the hook

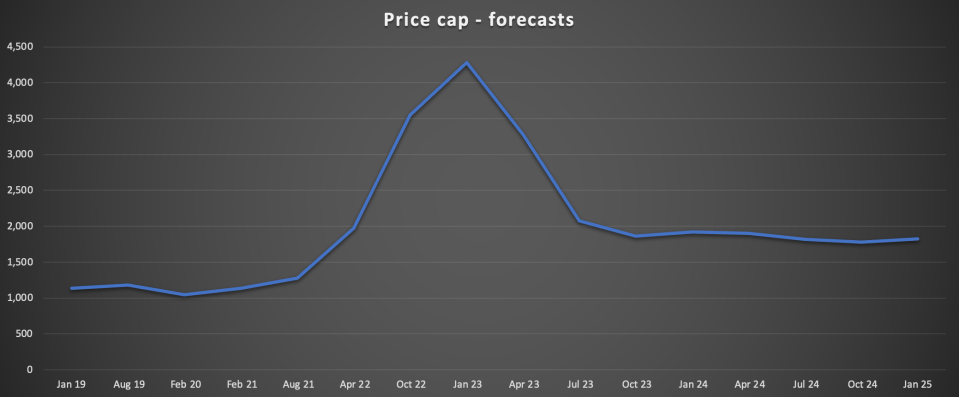

Cornwall Insight does not expect household energy bills to ease anytime soon, with the forecasters predicting that the energy price cap will stabilise next year between £1,800-£1,900 per year.

For context, the price cap is currently set at £1,923 per year – which is just £48 per year below last April’s figure, which was at the time a record spike, and way above pre-crisis levels of £1,000 – £1,200 per year

This reflects extensive pressure on households to meet the cost of their energy bills, with instability driving up prices for them even if supply needs can still be met.

With the UK already weighed down under its highest tax burden and the nation’s finances depleted support packages for the pandemic and last year’s crisis, the prospect of further help this winter is unlikely.

The energy price cap is expected to remain historically elevated above conventional trading levels (Cornwall Insight)

Ofgem meanwhile, is expected to raise bills again to stabilise the market.

Meanwhile, businesses are in a highly challenging situation, where the capped levels of support are not enough to ease the pain of costly long-term contracts.

The latest spike will make it harder for them to agree new longer-term deals with suppliers.

As the government and the wider energy industry move to ensure that supply needs can be met this winter, it is important they recognise the financial burden Brits continue to face even if gas keeps flowing.

It is vital therefore, that the government pushes forward with long-term decisions to drive down prices.

This includes separating gas prices from renewable prices, so that households can benefit from the cheaper generation costs of clean energy, reforming the price cap so that the market functions effectively again, and reducing standing charges for customers.

Without meaningful changes, there will always be a cost crisis to go along with fears over supplies.