The Association of Mobile Money Agents has suspended its planned strike and demonstration over the controversial e-levy proposition.

The industrial action which was scheduled for Thursday, December 23, was to register their displeasure with the government’s proposed 1.75 E-levy, captured in the 2022 Budget and Economic Policy read by Finance Minister Ken Ofori Atta.

But a day to the intended demonstration, the association has made a u-turn.

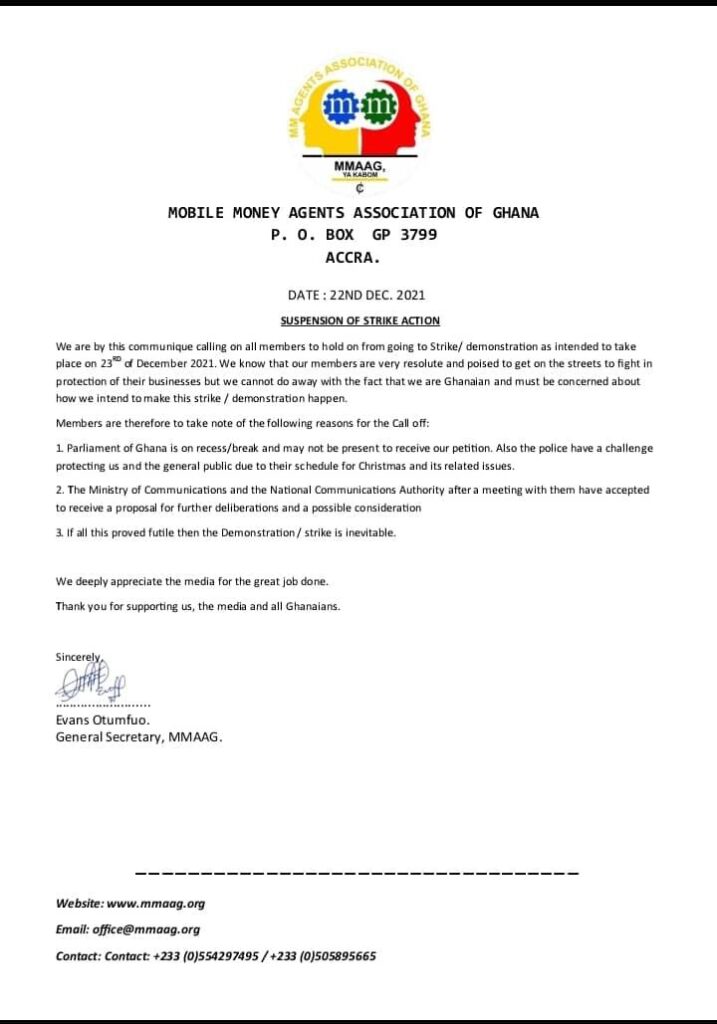

“We are by this communique, calling on all members to hold on from going on strike/demonstration as intended to take place on 23 December 2021.

“We know that our members are very resolute and poised to get on the streets to fight in protection of their business but we cannot do away with the fact that we are Ghanaians and must be concerned about how we intend to make this strike/demonstration happen,” the association said.

A statement explaining their new course of action said Parliament is on recess, and thus the difficulty in presenting a petition at the end of the demonstration.

It pointed that the police could also not guarantee their protection during the demonstration.

They also said the development comes after the Ministry of Communications and the National Communications Authority have agreed for further deliberations and possible considerations on the proposed levy.

Background

The intended strike comes after the government abolished all road tolls and replaced them with a 1.75% electronic transaction levy.

Electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances will be charged at an applicable rate of 1.75%, which shall be borne by the sender except for inward remittances, which will be borne by the recipient.

This move, the Finance Minister explained is aimed at boosting domestic tax mobilization efforts to infrastructure needs to accelerate economic transformation and safeguard efforts being made to enhance financial inclusion and protect the vulnerable.

All transactions that add up to GH¢100 or less per day (which is approximately GH¢3000 per month) will be exempted from this levy.

The E-Levy is expected to generate an estimated amount of GH¢ 6,96 billion in 2022, GH¢7.89 billion in 2023, GH¢8.92 billion in 2024 and GH¢10.09 billion in 2025.

A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.

The new policy is expected to come into effect from 1st February 2022.

Parliament divided over Levy

The Minority and the Majority are sharply divided over the levy and its implications for financial inclusion and the cash-lite society agenda.

The Minority has said it will do all it can to ensure that the bill does not see the light of day, insisting it is not in the best interest of Ghanaians.

However, the Majority has maintained that the levy will help the government raise the needed revenue to meet the infrastructural demands of the country.

Parliament will convene on January 18, 2022, to either approve or reject the controversial e-levy.

Discussions on the proposed levy

The Ghana National Chamber of Commerce and Industry (GNCCI) called on the government to reconsider the decision to impose a 1.75% levy on mobile money and other electronic transactions in the country.

The chamber maintained that the proposed levy would further worsen the plight of businesses particularly small and medium enterprises (SMEs) which were mainly growth-driven and susceptible to economic and market cycles.

It said to increase revenue, the government should rather focus on finding innovative ways of widening the tax net, ensuring tax compliance, as well as addressing the rising levels of tax exemptions which did not commensurate business growth.

Investment banking firm C-nergy Ghana Limited joined the chorus in admonishing the government to review the proposed Electronic, Transaction Levy.

Even though C-nergy is not entirely opposed to the levy, they hold the opinion that “the 1.75% E-Transactions levy rate is high”.

Analysts from the firm are of the belief that the scope and coverage of the levy are wide enough to generate the targeted revenues “if it is monitored and managed effectively”.